More than 💵 ? Central Bank Digital Currencies

In December 2022, The Free-Range Technologist is exploring Central Bank Digital Currencies.

Our monetary system is being disrupted by cryptocurrencies, perhaps for good, but it seems like mainly for worse in days of late.

These “network-made” assets now account for about 5 - 7% of the world's money and are not controlled by any central authority or payment services provider. Cryptocurrencies allow fast settlement and cross-border transactions for anyone with an internet connection and a mobile phone.1 In many ways, cryptocurrencies don’t help the unbanked get bank accounts but instead turn them into banks, with the ability to “mine” cryptocurrencies into existence and transfer assets without any central server or authority.

During the past four years, governments around the world have been responding with regulations and "crypto-like" updates to their currencies known as Central Bank Digital Currencies (CBDCs).

CBDCs are not cryptocurrencies but are digital dollars that may exhibit some of the same characteristics as cryptocurrencies. Public blockchains like Bitcoin are characterized by ten properties:

Permissionless. Anyone can become a node on the network, make transactions, etc. No central authority or server must grant permission for you to participate.

Borderless. Assets (such as Bitcoin) can be sent from one user to another, regardless of location. You can be part of the network if you have a network connection.

Transparent. All transactions on the network are viewable by anyone.

Neutral. The system doesn't block certain transactions or transactions from specific users. It doesn't care if you are selling teddy bears or drugs. Every transaction is treated the same (and is generally anonymous)

Verifiable. Every transaction can be verified independently through electronic signatures and cryptography.

Censorship resistant. A government can't prevent a transaction from happening. One use for public blockchains might be storing media and resources published by dissidents living under authoritarian regimes so that those regimes could not take the material offline.

Immutable. Records, once written, cannot be altered or deleted. Immutability is why a lot of large accounting firms have blockchain projects.

Decentralized. All network nodes have a full copy of the ledger. There is not one central database—everyone has a copy. The network votes on how the network might change and what is a correct entry in the ledger

Open sourced. All the underlying code is available to view and download.

Anti-fragile. Attacks on the network or bugs in the protocol are quickly fixed, and the protocol becomes more robust over time. Note: if you could hack the Bitcoin network, you would have access to billions. No one has yet to be able to do so.

No CBDC proposed by a central bank meets all these criteria, but instead borrow ideas and technologies from the cryptocurrency realm.

CBDCs represent a claim against a central bank, and most central banks around the world are either researching, piloting, or adopting a CBDC for their currency. For the latest country by country updates on CBDC developments, visit or cbdctracker.org or the Atlantic Council’s CBDC Tracker.

Wholesale, Retail and Hybrid

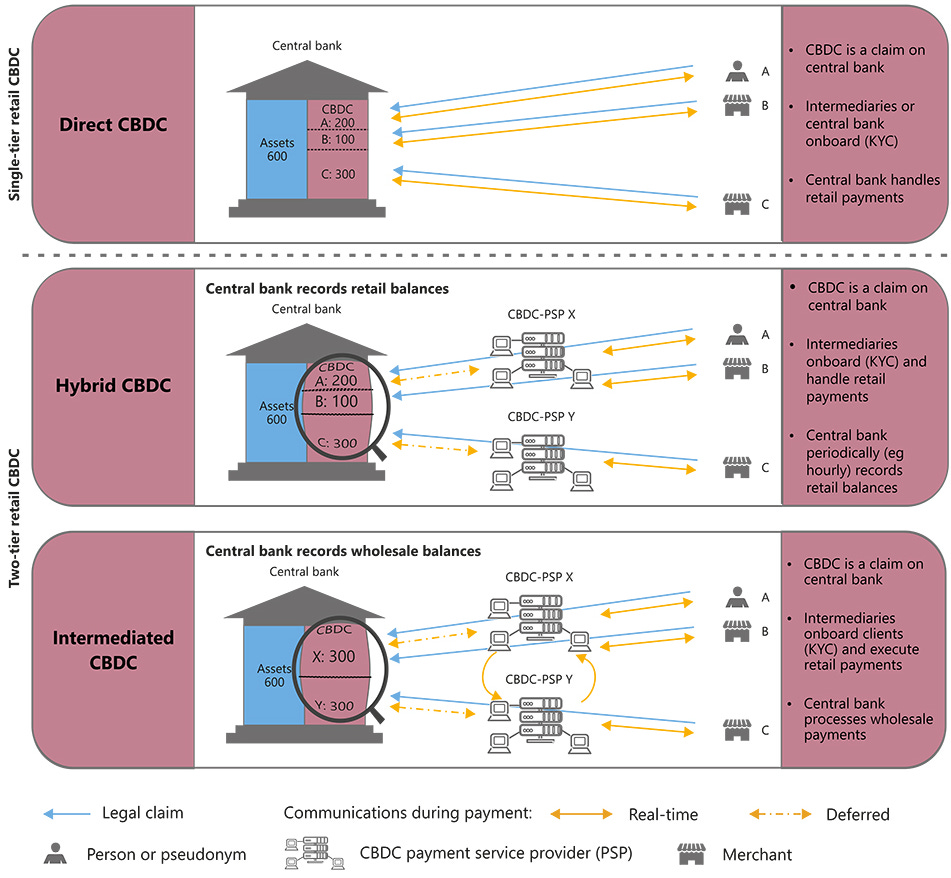

There are several models for CBDCs, each with its own benefits, risks, and opportunities.

The primary use of wholesale CBDCs is bank-to-bank transfer of funds and could be a much faster and cheaper way to settle and transfer funds between banks than the current ACH and SWIFT systems.

Retail CBDCs could allow consumers to access funds in a nation's central bank. Peer-to-peer transactions between individuals and businesses would be possible without settlement through a private bank or other intermediary. In its most pure form, a retail CBDC could be like bitcoin and other cryptocurrencies, with consumers having a wallet that would store the private and public keys used to access funds.

However, the central bank would likely act as a custodian for an individual's wallet so that a loss of an individual's wallet would not cause them to lose access to all their available funds. Considering that over $200 billion of blockchain assets are inaccessible because individuals have lost access to their wallets, a custodial system for CBDC wallets would be needed, at least for the majority of funds held by an individual.

Many hybrid models have been proposed with banks or other financial institutions acting as intermediaries and custodians, sitting between the consumer and their central bank assets, see the figure below.

Regardless of the technical and administrative structures, retail CBDCs would provide many of the same consumer-level benefits that cryptocurrency provides, including quick transactions and very low fees for transferring or exchanging money, with or without payment gateways and intermediaries.

Just as in the world of cryptocurrencies, new developments in the world of CBDCs happen weekly if not daily. The Bank of International Settlements (BIS) report on their third survey on CBDCs showed that while central bankers see promise in wholesale CBDCs, skepticism remains about the use of CBDCs at the retail (consumer) level.

In emerging market and developing economies, where central banks report relatively stronger motivations, financial inclusion and payments efficiency objectives drive general purpose CBDC work. A testament to these motives is the launch of a first “live” CBDC in the Bahamas. This front-runner is likely to be joined by others: central banks collectively representing a fifth of the world’s population are likely to issue a general purpose CBDC in the next three years. However, the majority of central banks remains unlikely to issue CBDC in the foreseeable future.

— BIS Papers No 114, Ready, steady, go? – Results of the third BIS survey on central bank digital currency.

More than money

When a technology enables a process or asset to move from the analog world to the digital, or a newer digital technology comes on the scene, we too often limit our thinking about future possibilities to the current way we conduct business.2 For example, when the internet and world-wide-web was introduced, it was viewed as a wonderful new way to send letters, access library holdings, view art, and discover recipes. Today's internet is built on much of the same technology but enables applications far beyond what we thought possible when it started.

Central bankers should be cautious about consumer-level CBDCs. While these digital dollars might certainly be used to make payments, transfer money between individuals, buy candy bars and pay bar tabs, CBDCs could enable many new applications as they evolve. Some of these applications would be welcome by certain governments and soundly rejected by others. Once adopted, a government might find it challenging to abandon or transition away from a digital dollar or euro.

It would be wise to ask: What could be done with retail CBDCs that can't be done with today's dollars?

Economic transparency

On public blockchains like Bitcoin, all transactions can be viewed by anyone, and the sender and receiver of funds are identified by their public key. This makes auditing of blockchain transactions simple, but the identities of the parties are unknown unless a public key is linked, intentionally or unintentionally, to an individual. As such, most blockchains are considered pseudo-anonymous.

Similarly, CBDCs using blockchain technology could allow for a pseudo-anonymous ledger in which all the transactions occurring in an economy could be viewed nearly in real-time. The government, and perhaps the public, would instantly know what assets were being bought, sold, or held. And the central bank might know individual identities.3

Adjustments to the economy could happen in real time instead of waiting on spending reports and new policies. Elective representatives could include triggers in economic policy tied to thresholds that could be traced and tracked in the national ledger. If electric vehicles (EVs) are not selling at the rate needed to meet a national target, then incentives for EVs could be automatically increased until sales improve. Economic policy adjustments could happen daily, hourly, or minute by minute, and usher in the era of high-frequency government!

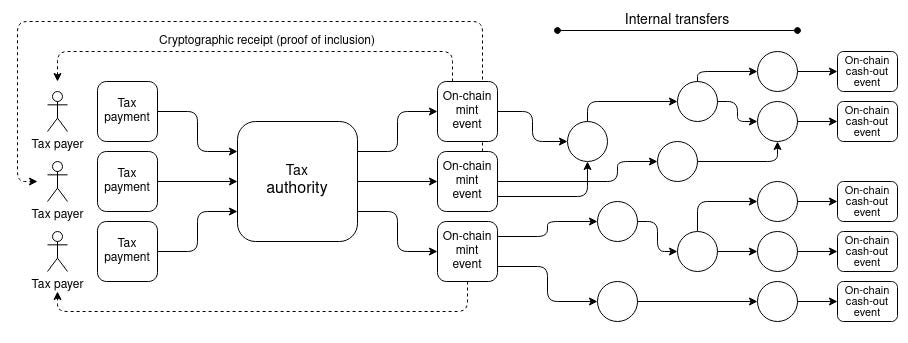

Governmental transparency

Likewise, a blockchain-based CBDC could allow citizens to view transactions made by their government. Citizens could see the flow of tax dollars being transferred to agencies, states, and local governments and see it exit when a vendor or employee is paid. Such a system could go a long way toward reducing the information asymmetry between the public and the so-called “belt-way bandits” who seem to possess an outsized influence on government spending.

Such transparency could increase transparency in government spending at all levels.

Students attending public universities could "follow the money" from when they pay a tuition bill to when the custodial staff is paid. Students and parents would understand how much tuition and tax dollars are allocated to educating students vs. supporting vanity projects.

Even if a government thinks that such information transparency would be a good idea, that attitude might change when their citizens are using another country’s digital currency. As the Bank of England researches and debates the merits of a digital sterling, Sir Jeremy Fleming, the head of the United Kingdom’s intelligence and security agency, General Communications Headquarters (GCHQ), is raising concerns about how CBDCs can be used to collect information from Brits traveling abroad.

Ahead of the 2022 Olympic Games in Beijing, Fleming said “In the context of the forthcoming Olympic Games . . . China is taking every opportunity to project their digital currency, and their hope is that foreign visitors will use it in the same way as domestic visitors.”

“If wrongly implemented, it gives a hostile state the ability to surveil transactions,” said Fleming. “It gives them the ability . . . to be able to exercise control over what is conducted on those digital currencies.”

Combatting the Cantillon Effect

When central banks put more money into the economy, that money tends to stay closer and have more benefits in and around the places it is created, that is, large banks and Wall Street institutions. This is known as the Cantillon effect and was first described by 18th-century economist Richard Cantillon. Austrian economist Friedrich Hayek compared it to putting honey in your tea. It blobs up in the bottom of the cup and takes a while for the sweetness to disperse.

Retail CBDC would allow governments to airdrop money directly into the wallets of those who need it. Need to help hurricane victims? Airdrop money into the wallets of everyone in the affected area. Want to stimulate spending in a depressed economic area? Don't set up a new program or bureaucracy to help people. Instead, airdrop money to people living in that area. Governments can bring money into existence with a laser focus on who gets that money, sans intermediaries. Opinions may differ on the benefits vs. the costs of government aid, but it is hard to deny the efficiency of just giving money to people who need it and will spend it.

China is the country that has the most experience with airdropping money. Various pilot projects have airdropped millions of digital yuan Yuan (e-CNY) in to the wallets of citizens in preparation for a nation-wide roll out of the CBDC.

…..Next Week: Are we ready for programable money?🖥️

Continue the Conversation

What are your thoughts on Central Bank Digital Currencies? Can this technology help the unbanked and modernize our currency systems? Do you want the government to see all your transactions? Why or Why not? Does our monetary system even need to be modernized?

And let me know if there was something I didn’t explain well, and I will try to answer it in chat!

Use the Substack App and the link below to join in the conversation!

Endnotes

In the interest of readability and length. I have a made several abstractions and have not addressed critiques of so-called cryptocurrencies (mainly that they are not useful as currency).

Skeuomorphism is the term used by user interface designers when the design of new technology mimics existing designs or functions. For example, a trashcan icon on a computer desktop mimics that of a physical trash can in an office with similar functionality.

To be entirely anonymous takes some work (wallets must be maintained by the individual, etc.). Most exchanges for cryptocurrencies (for example Coinbase) are Know Your Customer (KYC) compliant, act as a custodian for customer wallets, and report to the IRS, and will reveal a user’s identify when compelled to by law enforcement. Most models for a CBDC include KYC compliance at central bank level or at an intermediary.